What is money? Many economists have tried to define this omnipresent tool of human trade. Few have come close to a comprehensive analysis. The two men who in my opinion did the best job so far were Ludwig von Mises and Alfred Lansburgh (better known under his pen name “Argentarius”).

Mises as one of the most famous representatives of the Austrian School is of course more well known than Lansburgh, but while I greatly admire the man, this time I need to side with Argentarius.

The two theories are rather close and not entirely incompatible, but a few key differences exist, and I think they are due to Argentarius seeing what Mises overlooked. Let me explain…

While Mises traces money back to the value of the underlying commodity (Regression theorem), Argentarius adds another layer to the analysis. He does not dispute the history, how commodities became monetary tokens, he rather claims that the concept of money is entirely separable from the underlying commodity and much older.

While I cannot lay out in a few lines, what Lansburgh explained in an entire series of books, let me try to rephrase how he claims money evolved.

Why are money tokens even necessary?

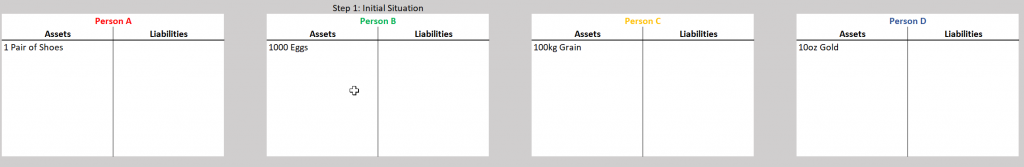

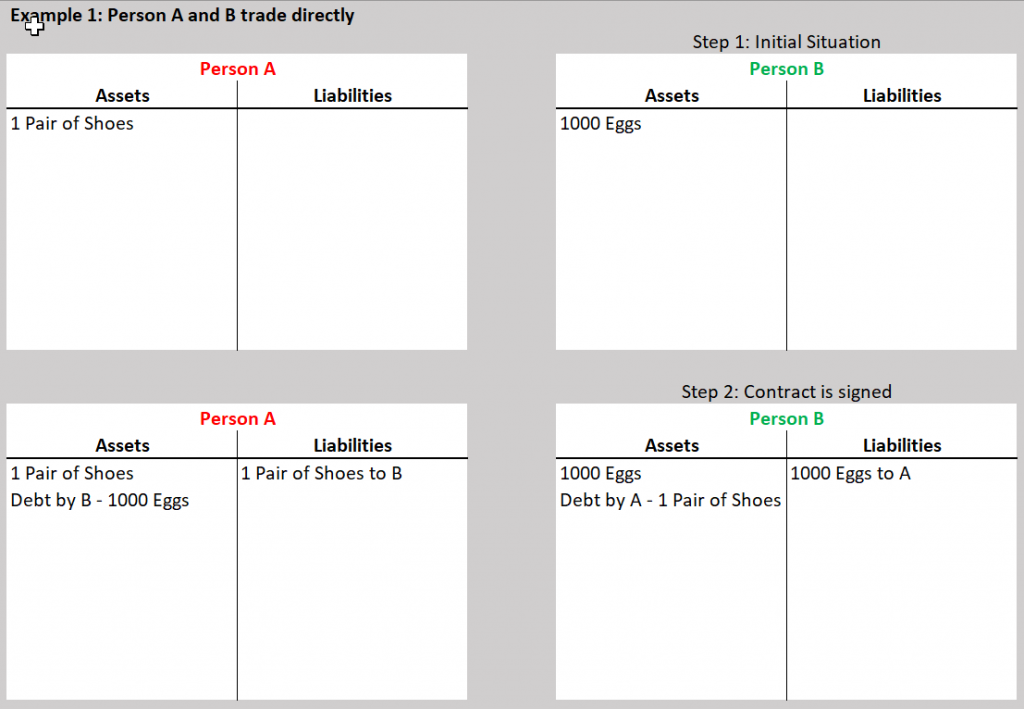

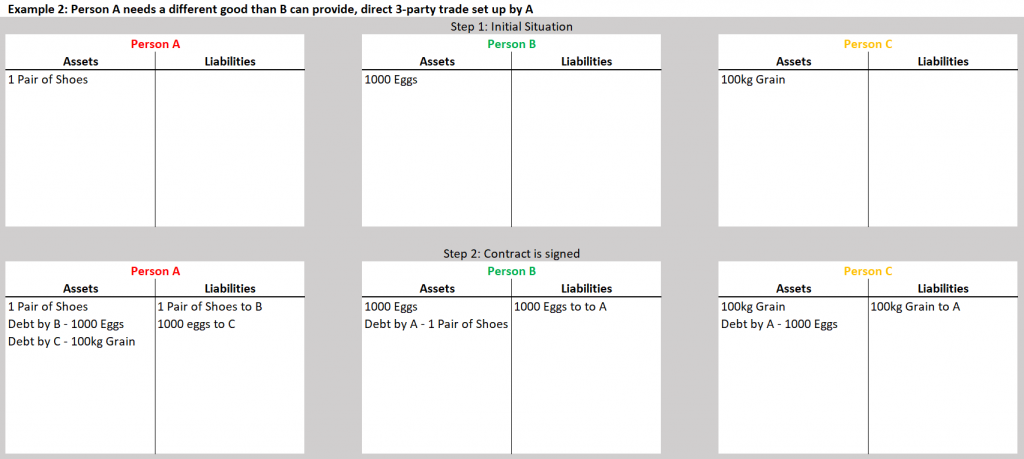

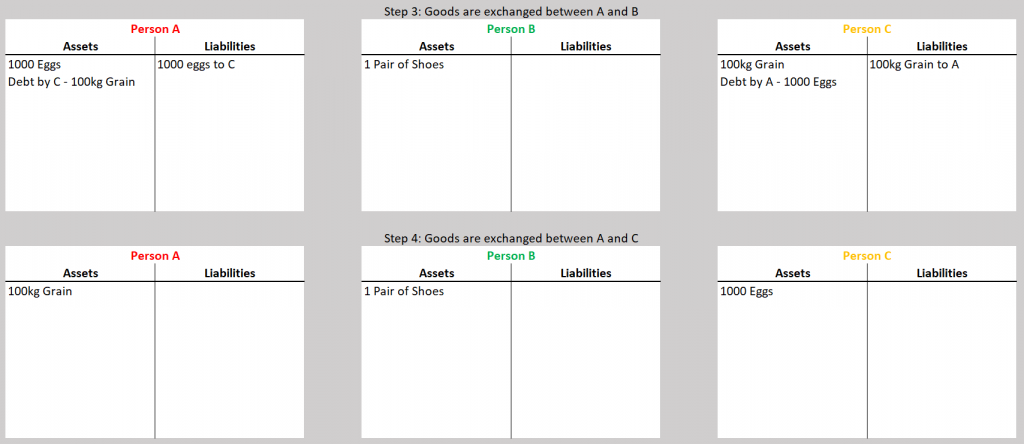

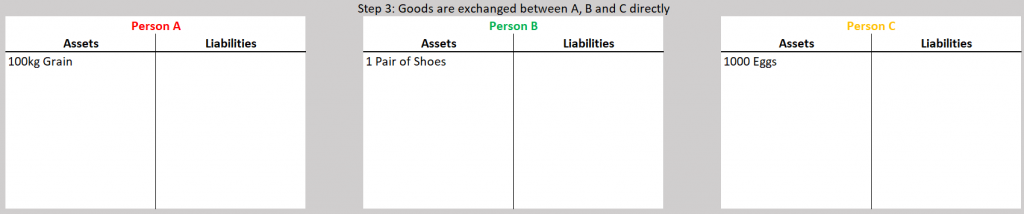

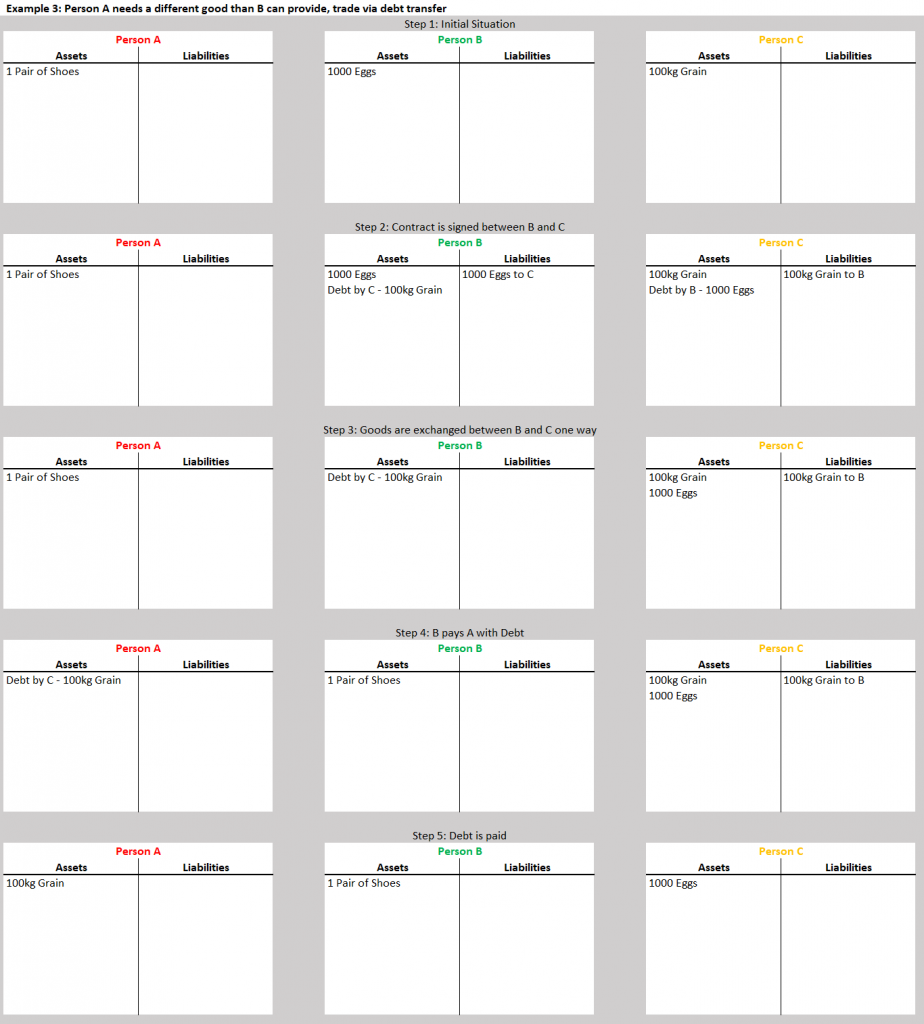

Whenever you trade with other people or render them services, one side will inevitably need to grant the other side credit at some point. Few goods can be exchanged one to one at the spot.

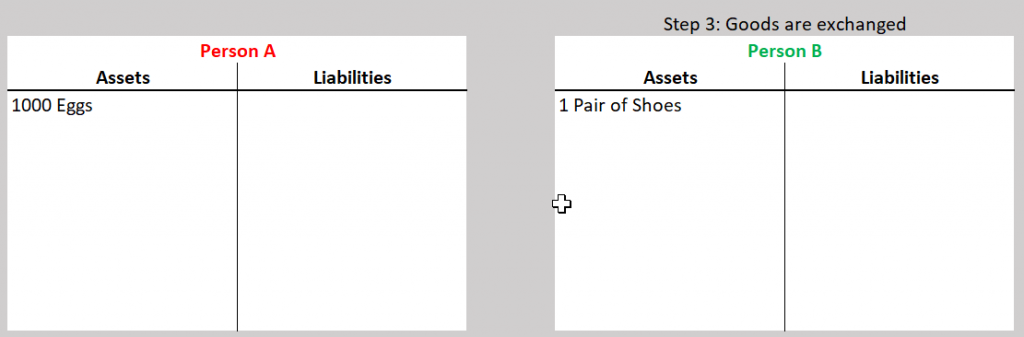

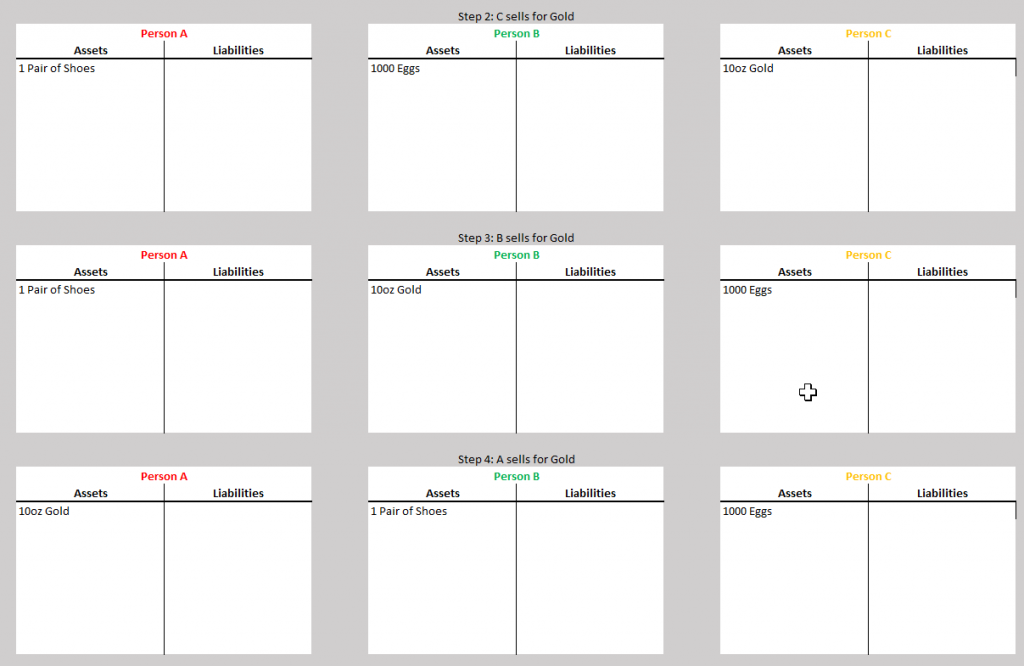

If you pay for a pair of shoes with eggs, for example. It will neither be practical nor helpful, if you deliver the payment of a thousand eggs at once in exchange for the shoes.

Rather, you will make a deal with the shoemaker, where either you deliver 1000 eggs first, in household quantities, over say a year (i.e., you give the shoemaker credit) or you get the shoes first and then pay off the debt with eggs over time (the shoemaker gives you credit).

In ancient human history, such debts were either remembered by people or chalked down. We know that as much as 5000 years ago, people would use clay tablets to record ledgers of such commodity debt contracts, e.g., in Mesopotamia.

This debt is what Argentarius calls “money”. Or more precisely, the debt that results from a contract that has been partially fulfilled. Looking at archaeological findings, it seems that Argentarius is indeed correct, and these ledger-based debts go back further than commodity money.

Of course, we need to note here, that what we colloquially call “money” is different from Lansburgh’s definition. In day to day life, we usually equate the money tokens or currency with “money”.

So, when we compare the different theories, we need to keep in mind that Argentarius calls the virtual debt “money” and the physical currencies “money tokens”.

Why and how did humans even switch from a virtual, ledger-based debt “money” to token money?

The answer lies in the growth of civilization. While, a debt denominated in individual goods and services and recorded in virtual or physical ledgers, may work for a city or even a state, the bigger and wider trade networks become, the less practical it becomes—especially for small transactions.

Just imagine either a harbour innkeeper having to know all his customers and remember their tabs, or a central national clay-tablet database recording every beer drunk in the nation and not yet paid for.

Thus, tradesmen started to seek for a standardized medium of account, similar like kings standardized length measurements to multiples of their foot. The problem with value is that it is subjective, however.

As Mises correctly points out, all humans rank their possessions hierarchically, but cannot quantify them because there is no SI unit for “value”.

Your kid is hopefully more valuable to you than a donkey you own, but if you had to put a numerical value on either, you wouldn’t be able to. Unless, of course, you compare it to a good or service you need right now that is of equal or greater value to you.

If there is a famine, you will probably first sell your donkey for grain because the grain is more valuable to you than the donkey. And the grain and donkey are both less valuable than your kid, so you don’t even consider selling the kid at first.

If the famine continues, however, you may come to a point, where you start to think about how much food you could get—for you, your wife and your four eldest children—if you sell the fifth and youngest kid.

I know, this example may sound cruel to us today, but it was a tough choice people often faced historically and even in Central Europe as recent as 150 years ago children were still occasionally sold to feed families.

So, how exactly do we calculate values, prices, debts in a standardized way then?

How many money tokens equal one child, and how many money tokens equal one loaf of bread? If we want to express values comparably, we need to develop a solution to this, we need to find a common denominator.

This is especially important for an economy, since something as valuable as a child, is worth more than a single merchant can supply in useful goods. If we wish to trade extremely high-value goods, for relatively low-value ones, we need a standardized way to express value and debt, so we can defer a transaction in party.

What do I mean by that?

In our example, even if the grain merchant offers you 5 tons of corn for your child, this will not help you feed your family. You are unable to transport and store 5 tons of grain, and you will need other goods, like drinkable water, basic shelter etc. that the corn trader cannot deliver.

A good money token thus needs to allow not only for the monetary functions of the historical ledger-based money (transferring a transaction in time and place), but also to transfer a transaction in party, i.e., a way to collect debts from another person than the one you are directly trading with.

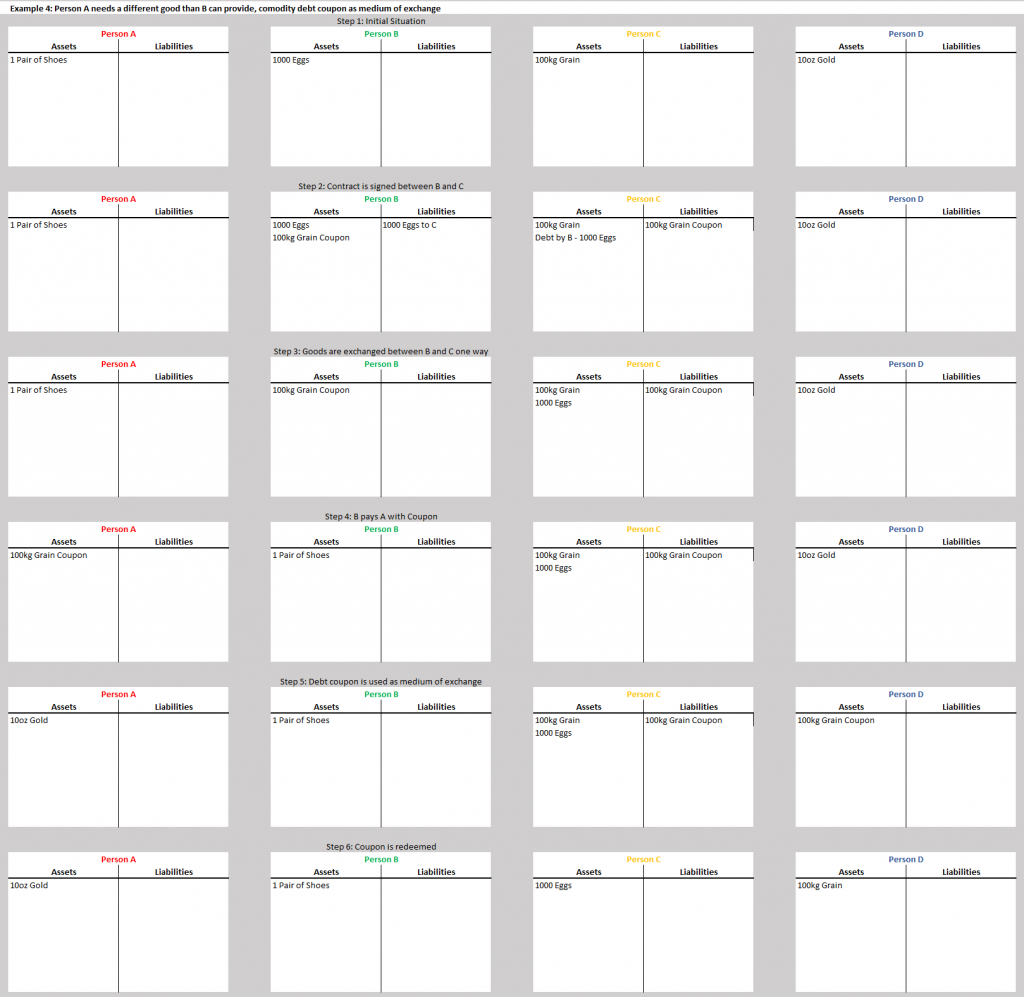

One way this has been achieved is that traders of staple commodities, like grain, would give out coupons redeemable for their good instead of the good itself.

In our example, this means that instead of 5 tons of grain, the father receives 5000 coupons redeemable for 1 kg of grain each.

With these coupons, the father can then pay the shoemaker for new shoes, the well owner for some drinking water etc. This works because all of these merchants also need grain.

While this coupon money, solves the problem of transferring a transaction in party to some extent, it still does not solve the issue of a universal medium of exchange. Only people needing grain and trusting the merchant issuing the coupons will accept the coupons as payment.

(Of course, some will also just trade the coupons, but for brevities’ sake, we will exclude this from our analysis here.)

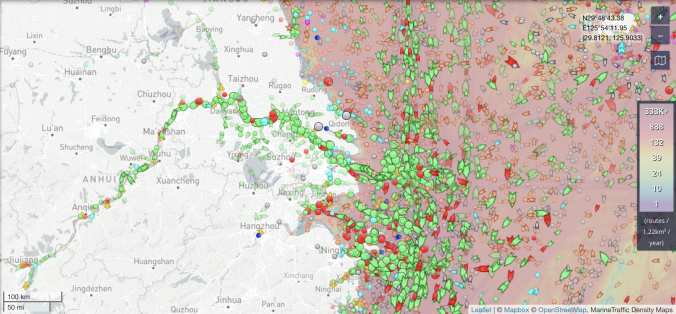

Furthermore, the validity of such coupons will be limited geographically. A merchant 500 miles away, is not likely to take a coupon he can only redeem by travelling to a far away city and redeem with a merchant, he does not personally know.

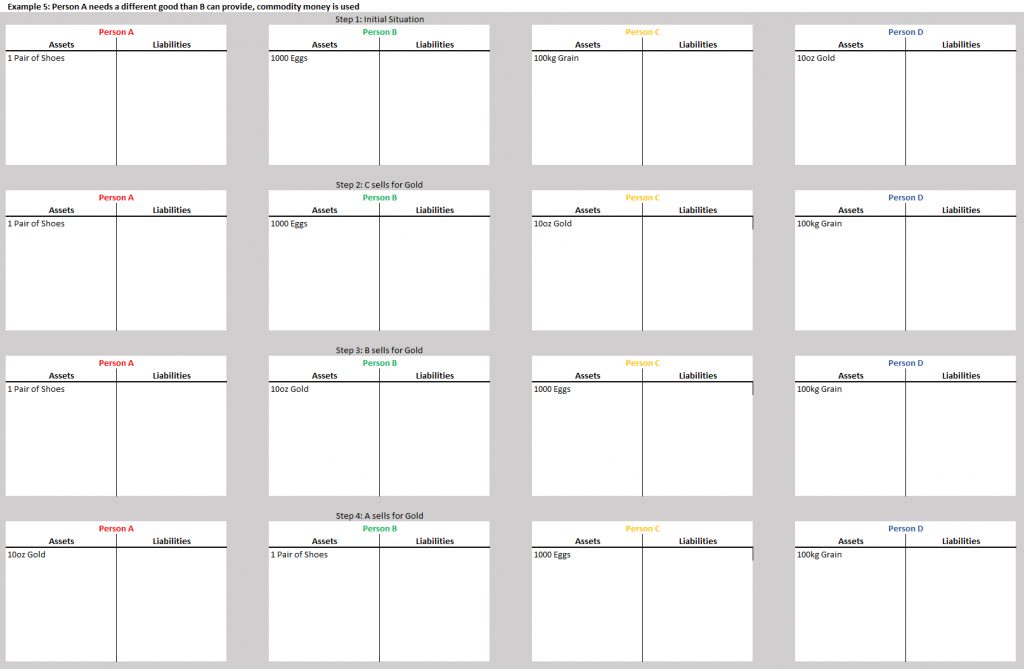

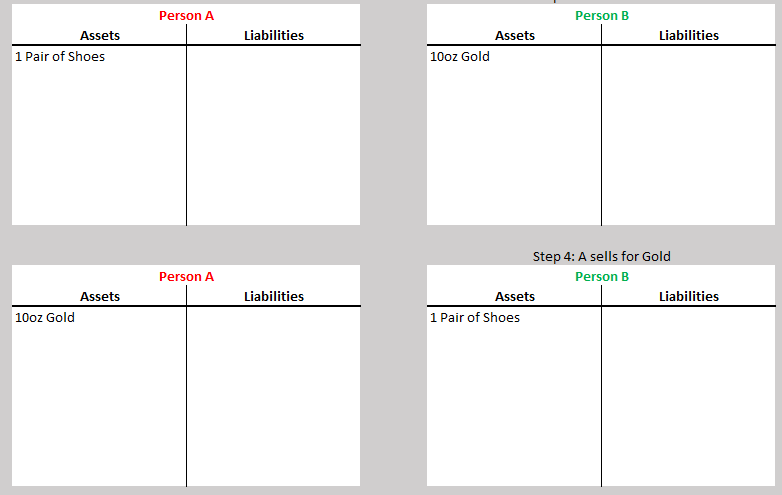

Thus, the market found a solution in money tokens which had some market value independent of the exchange value guaranteed by some central entity. Historically, precious stones, cowrie shells and metals like Gold and Silver were chosen. Why and how specific goods were favoured over others, is explained brilliantly by Mises, so I won’t go into it here.

Once a money token or commodity money gets dominant in a region, either by market choice or by government decree, it finally evolves further into a “medium of exchange”. This means nothing more than that the money token (e.g., a gold mark or paper mark) is universally accepted as a placeholder in transactions and every good or service over time establishes a “market price”, denominated with the token.

The market price of a good or service, is the closest approximation one can objectively make to the subjective concept of “value”. This does not mean that every person values the same good or service at this market price, but rather that on average the marginal utility of both sellers and buyers of the commodity meet at this price, under current conditions.

So with the “market price” a medium of exchange finally allows us to express the “value” of things in a standardized, quantifiable manner and transfer transactions in time, space and party.

In a nutshell, this means that whatever good or service you are trying to exchange for whatever other good or service, you can just use the dominant money token instead.

The implication of this being that instead of having your employer pay you for your work in shelter, food, clothing, etc. You can receive your salary in the money token and then exchange the token for the desired goods at any merchant.

Up to this point, Mises and Argentarius largely agree, even though they place their emphasis on different aspects of the process.

Let us recap:

Argentarius traces the history of money back to “contractual debt”, tracked mentally or on clay tablets, which then became coupon money and then commodity money and then by choice or decree a medium of exchange.

Mises, on the other hand, traces the evolution of commodity money, by a free market process. Defining this type of money token as “money” if it is used as “universally employed medium of exchange”.

Both economists agree that a monetary token dominant in a given market/country becomes a universal medium of exchange. They disagree in the core definition of money.

To Argentarius, “money” is an abstract concept. A placeholder for a debt in an open transaction. Money gets born when somebody renders someone else a service and has not yet received the compensation. As soon as the transaction is completed, i.e., the debt is paid, the virtual money disappears. A money token in this context is used only to represent and quantify the abstract money.

The implication of this is that any given transaction is only finalized, once both parties have received the actual goods and services desired by the transacting individuals.

So, in the case of the shoemaker, it does not change the transaction, whether the shoes are paid for in eggs or whether the eggs are sold for a money token and then the shoes bought for such a token. The transaction is only finalized once the shoemaker in turn has exchanged the money token for eggs.

Mises, on the other hand, attests the monetary token a marginal utility of its own, reflected in the market prices of all goods and the monetary premium the token has over the commodity it consists of.

Here I see the flaw in Mises’s argument.

If a monetary token is accepted as payment for its own sake—as a commodity—and not to be re-traded for something else, then in this case it has not acted as “money” at all, but as common barter.

When a money token is used as a placeholder in a transaction—to transfer a transaction in party—it is not valued by the parties for its commodity value, but exclusively on its monetary premium.

This monetary premium arises not by the market pricing of the underlying commodity, but rather by the act of capturing the market price of the desired goods.

We do not use a money token because we want to own it, and we don’t price it for its own sake, rather we use the money token because we want to buy something that our trade partner cannot deliver, and we expect the token to have the same “value” as the good we desire.

So, why is the view of Mises—namely that a transaction is finished once a money token has been handed over for a commodity—problematic and factually incorrect?

To see this, we need to study an extreme example:

Let’s say two people, called Alice and Bob, want to do a barter trade. Alice exchanges a Picasso painting for a serial-number-one sports car of Bob’s.

The Picasso is delivered to Bob, but Bob’s wife hates it and immediately trades it for a van Gogh. The sports car is put on a lorry and shipped to Alice.

Unfortunately, the truck has an accident and the car is damaged beyond repair.

Now Bob is in a difficult situation. He does not have the one of a kind commodity he owes, and he also doesn’t have the one of a kind commodity he received, for the transaction to be reversed.

Naturally, Bob offers Alice the van Gogh painting, since to his family it had the same value as the Picasso. Unfortunately, Alice hates van Gogh as patently as Bob’s wife hates Picasso.

How does Bob pay his debt?

The common way to resolve such a dispute is to involve a mediator, often a court. Given that the two parties are unable to agree on a fair substitute for the car, the judge will need to get an appraiser who determines the “value” of the lost vehicle.

According to Mises’s school of thought, this price should be denominated in the dominant medium of exchange of the area, while Argentarius would call for the money token dominant or decreed for the area.

If the two parties come from regions which have different media of exchange, the customary thing to do would be to use Alice’s medium of exchange, for she is the one who is the creditor.

If I explained this case well, you, dear reader, will have probably come to the conclusion that in most cases the two schools of thought will arrive at the same monetary token and valuation in this case.

Yet, the two cases could not be more, different. The problem I see is both of a philosophical and practical nature.

Let us start with the philosophical problem:

Under Mises’s doctrine, a free market process should be completely voluntary. Since he furthermore attests a marginal utility to the monetary token itself, the only way to view a court’s decision as “just” is, to ask Alice whether the marginal utility of the money token is equal or greater than the marginal utility of the lost car. If Alice does not value the possession of the money token itself, the marginal utility of the token is zero and Alice has, in fact, been robbed by the court.

If Alice, however, attributes a value to the money token solely based on the expected resale value, this means that she does not really attribute any marginal utility to the token itself, but rather values the token based on the marginal utility of what she expects it to buy her.

So in the first case, a “just” solution is impossible. In the second case… well, in the second case Argentarius was right all along.

Now, philosophical and moral implications aside. What are the practical issues with Mises’s theory?

To understand the significance, we need to first call to our attention, why economic theories are important.

Over the past few centuries humanity’s standard of living has been rising steadily, thanks in large parts to the advancements of science. If you have a better understanding of how the world works, you can create better products to enable you to satisfy your basic needs easier and to also address higher order needs, otherwise unsatisfied.

In economics, one of the most important pieces of understanding required, is how scarce goods can be best allocated. The best process discovered for this so far is the “free market”. The free market according to Hayek is so good at this because the market price effectively is an aggregate of the knowledge and information possessed by the market participants. With billions of people participating in a free market, it seems obvious, why this process must be better informed than any group of central planers.

But what if market participants are missing a piece of information or collectively share a piece of wrong information?

The inevitable consequence is a misallocation of goods and services. Sub par products will win out over better products, and many innovations will never come to fruition.

This is particularly devastating to humanity, if the error lies in the very tool itself used to express market prices, namely the monetary tokens.

With Mises’s theory of money, you can understand what a “good” token is only to the extent at which it is accepted by market participants as a commodity.

Failing to see the function of a monetary token to quantify and standardize the underlying abstract concept of “money”, it is likely that suboptimal tokens are chosen by market participants and that better tokens only emerge by accident or not at all.

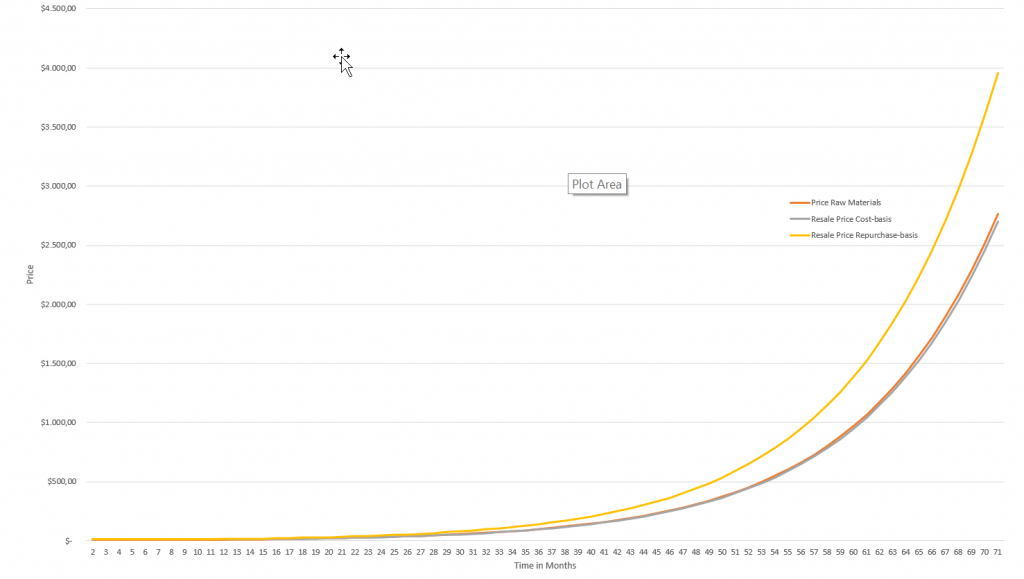

The key difference in the two theories thus is that Argentarius requires a “good” token to be stable in “value” from the time a contract is made to the time it is finalized, which in this case is not the moment the token is handed over, but rather the moment the token itself is redeemed.

Let us look at an example of where the fatal consequences of Mises’s theory become visible, namely the Weimar Hyperinflation.

As early as the year 1921 Lansburgh saw that the majority of people in Germany were confusing monetary tokens with “money”. They bought and sold goods using money, thinking the transaction was finalized when they handed over the Mark bill and overlooked that in reality their intention was not to have a Mark bill, but to spend it.

The consequence of this error was what Argentarius calls “selling themselves poor”. Shopkeepers and industrialists priced their products in Marks, based on the current market value of the Mark, instead of on the expected market value of the Mark when they needed to restock.

Thus, shops often found out only after they had sold their whole inventory that the Mark had fallen so much in value that they couldn’t afford filling up their shelves and had to go out of business.

Enough for today.

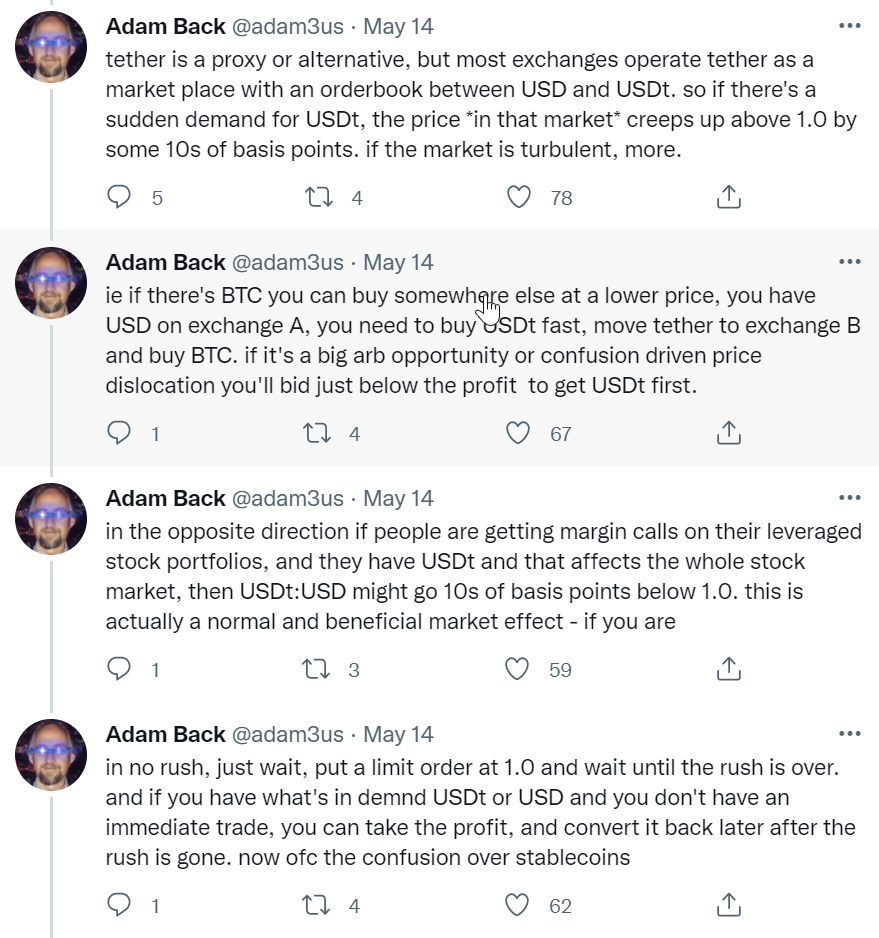

Thank you, dear reader, that you stayed with me for this long. In one of the following issues, I plan to go deeper into what a “good” money token is and why the Euro-Dollar system is currently going into hyperinflation.