Today I have to write an article I hoped to never need to write. An article, where I potentially slay my heroes…

The recent crash of UST (Terra / Luna), sparked the mainstream media to also attack other stablecoins, specifically Tether. This then forced Tether CTO Paolo Ardoino to come to defend his baby. Which was done in the form of a Twitter space and came to my attention as the following sound-bite.

If you know me, it probably is clear to you that I can’t stand it when my heroes shitcoin, so I snarkily asked whether Samson Mow and Adam Back are really ok, putting their names under this message.

Unfortunately, the answer from both seems to be “yes” (see here and here) and discussions about Tether ensued. Before we get any deeper into this, let me preface it, to keep misunderstandings to a minimum:

My personal opinion is that Tether is probably the best, least shady stablecoin out there. The reason I am picking on Tether is that it was the subject of the discussion and because my issues are with stablecoins in general, so best to pick the highest low-bar to attack.

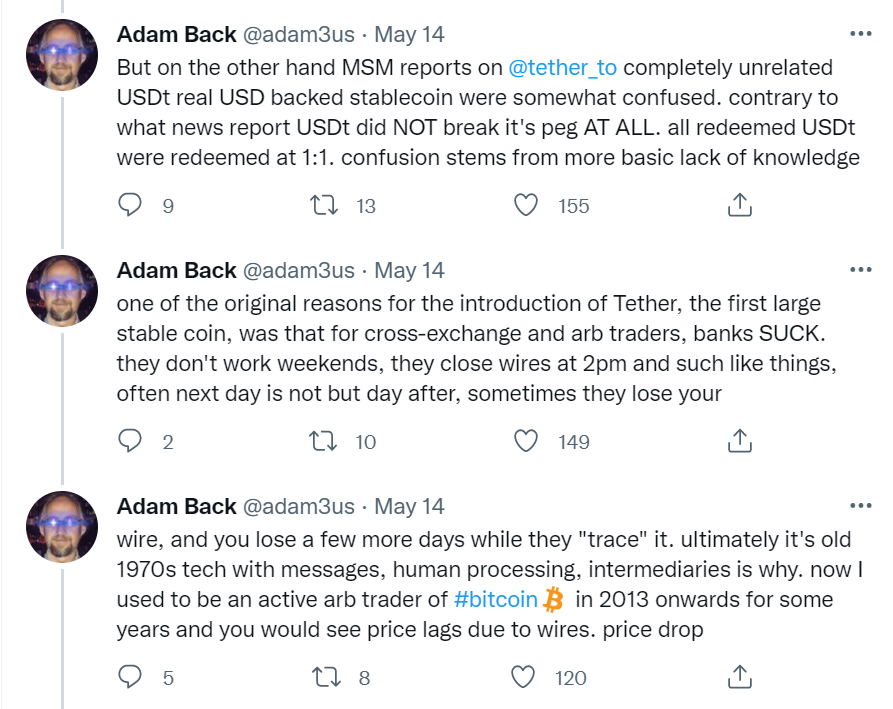

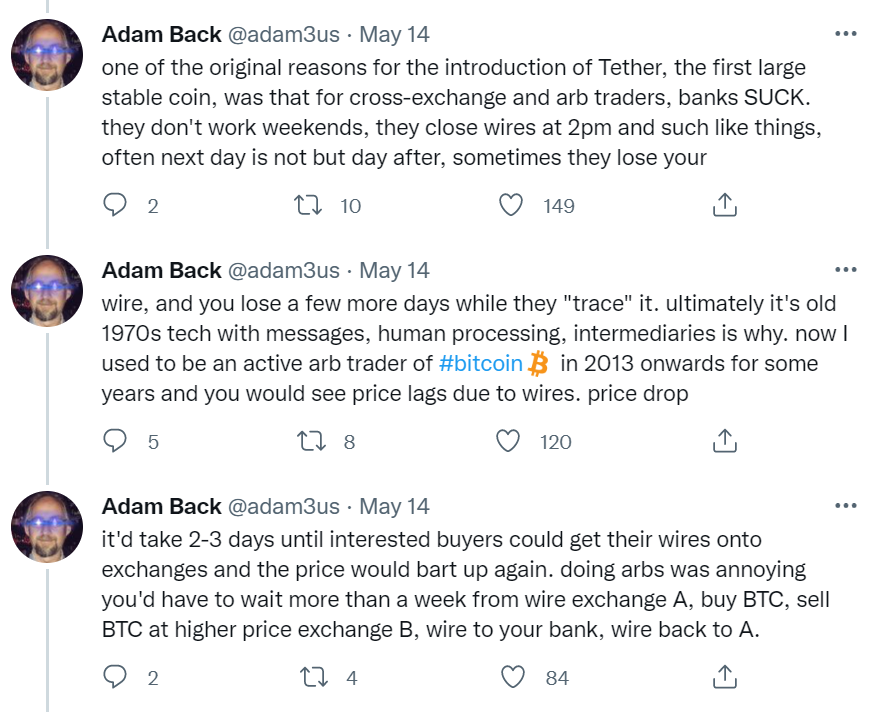

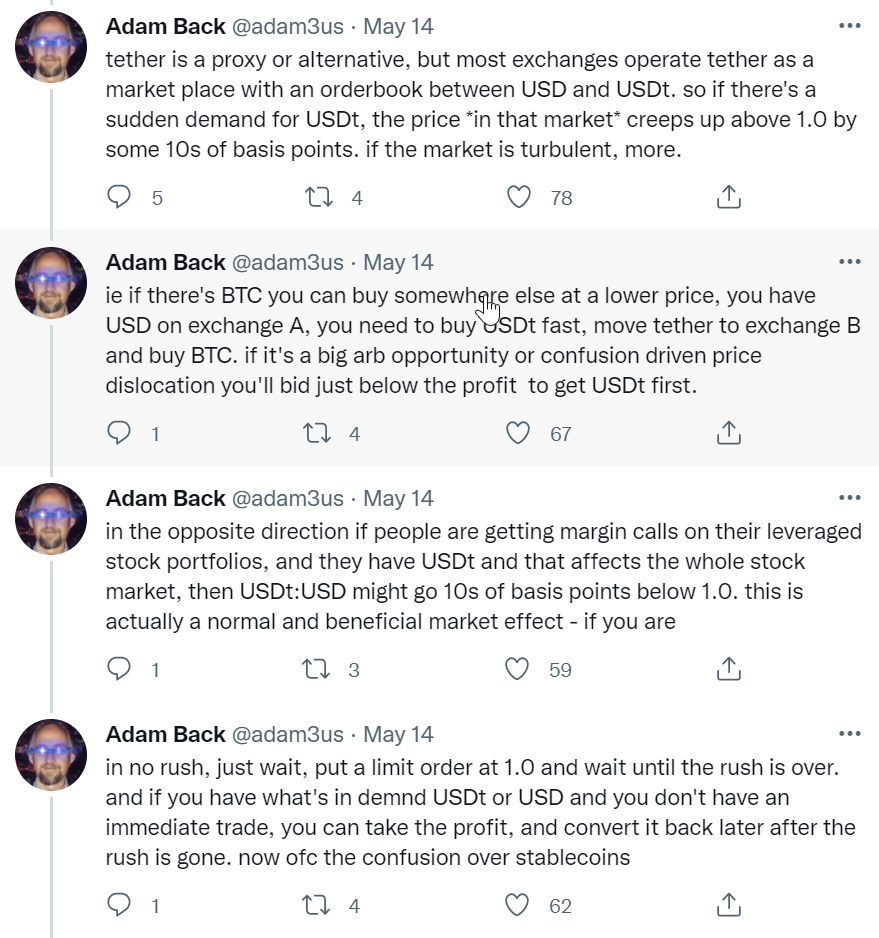

In his response to me, Adam Back linked a thread, where he defends Tether and I highly encourage you to go read it in full, here. In this article, I will address the points I consider most important only.

Yes, Tether kept its promise to redeem all its coins 1-to-1 even though an impressive $7.6 Billion were withdrawn in the recent crypto panic, caused by the UST collapse.

On the other hand, it is also true that Tether trades significantly below 1 USD at the moment.

This raises the question: How?

How can Tether remain true to its promise to exchange 1 USDT for 1 USD, when the coin itself trades significantly below $1?

To understand this, we need to understand the different types of stablecoins out there. While I don’t know every little project, the majority of stablecoins seem to fall into one of two categories:

- Fractional Reserve/Algorithmic Coins

- Full Reserve Coins

UST (Terra), which recently collapsed, was part of the first category. While it was partly backed by hard assets, like Bitcoin, a large part of it’s backing was its own coin Luna.

The way Terra tried to keep its peg to the Dollar was with an “intelligent” algorithm that trades the backing assets and issues Luna tokens, to both maintain the peg and generate profit for the issuer.

I don’t think it is necessary to explain at this point, why and how this can go wrong, since we just witnessed the dumpster fire a few days ago.

Much more interesting is the second type of coin, which Tether falls into.

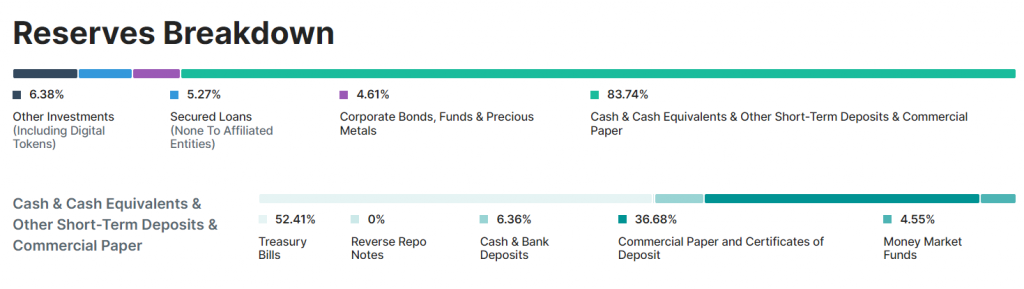

Fully backed coins promise to have low risk, very liquid assets fully (or in Tether’s case allegedly even over 100%) backing the issued number of Tokens.

For Tether the majority of this backing assets are “Cash & Cash Equivalents”, which essentially means treasury bills and money market securities.

So far, so good. Or maybe so far, so bad?

As a non-lawyer, I may be too stupid to understand correctly, but the only proof of this backing I have are periodic assurance letters , which in my layman’s understanding don’t actually give any basis for legal litigation whatsoever.

If I further look more into the legal terms on Tether’s homepage, it appears to me that there really is no legal recourse possible, should anything go wrong or should the assets listed be charts on a homepage only.

Furthermore, the terms seem to imply that the assets are not actually backing the USDT tokens directly. Rather, they appear to be the property of Tether Holdings Limited. So in case this corporation is liquidated, the shareholders will get the assets, not the USDT holders?

If any lawyer or Tether employee reads this, please reach out to me to help me understand this better and correct this article if necessary. Am I “concern trolling”?

Or are my concerns justified? Adam Back has my deepest respect for all that he has done for Bitcoin, but I am deeply worried that with Tether, he may be defending a shitcoin. Until he or anybody else can credibly answer my three questions below, we will not be able to settle this issue.

To get back into my depth, let’s assume for the rest of the article that the listed assets are actually real and Tether (or any other stablecoin), are honest.

Is a fully backed stablecoin an adequate alternative to a dollar?

Foremost, we need to talk about why we even need dollars or stablecoins in the first place, since Bitcoin is the best money token out there.

In an ideal world, we wouldn’t. Unfortunately, in the world we live in three major aspects make the US Dollar and other Fiat currencies a necessary evil, we will have to deal with for at least another decade.

- Legal tender laws—governments force you to pay taxes and debts in Fiat.

- Petrodollar—vital resources are still mostly traded in Dollars.

- Market adoption—prices need a while to form, for a unit of account the market needs to discover and stabilize a valuation for every good out there, which can take years, decades, or even longer.

So, we need the Dollar. Why do we require a stablecoin to represent it? Adam explains it like this:

Which is unsatisfying to say the least. To Adam, Tether seems to be a tool for traders only. If this was the only use case, then I couldn’t care less about them.

There is another point that is always used in marketing of stablecoins however that I am more interested in, namely merchant adoption.

If you are a company or merchant who wants to use Bitcoin, you are facing many legal, technical and practical hurdles.

In the US for example, Bitcoin is not treated like the foreign currency that it should be according to El Salvador’s legal tender law, but rather as an asset.

So, any transaction in Bitcoin creates a taxable event, where the merchant needs to calculate as if he sold his good for Dollars, received bitcoin and sold them for Dollars as well.

A bureaucratic nightmare…

To make matters worse, Bitcoin on the balance sheet can be a real hassle, since it again is not treated as cash reserves, but as an asset.

If Bitcoin price falls below the purchasing price in any given quarter, a company needs to show a fictional loss on their earnings report.

In a nutshell, this means that while Bitcoin+Lightning as monetary networks have many benefits for merchants and corporate users, the actual BTC can be a tax and reporting nightmare.

Thus, it makes sense at this point in time, to receive payments not in Bitcoin, but just send and receive Dollars via Bitcoin and Lightning. And since—as Adam pointed out—banks are slow and cumbersome and incompatible with the digital world, stablecoins seem to make sense.

Well, kind of…

They really do not resolve the legal and tax issues Bitcoin currently has. In fact, stablecoins exist in a legal gray area that makes them even less suitable for corporate use, IMO.

The real killer argument seems to be that stable coins reduce the risk of price fluctuations. If you get paid in Bitcoin Friday afternoon, by the time banks open again Monday morning, BTC may have dropped 10%.

In my opinion, it is a weak argument.

For one, there is considerable risk that any stablecoin breaks and turns out to be redeemable not for $1, but rather $0.

Secondly, this argument holds water only if a merchant is interested in owning Dollars, not Bitcoin.

If a merchant understands Bitcoin, he will want to hold all or most of his profits in BTC and the argument is moot.

At this point, we have identified only one reason to use stablecoins, namely if for legal and tax reasons, you want to use Bitcoin the network, without BTC the token. This naturally raises the question:

Are stablecoins the best option to transfer Dollars via Bitcoin+Lightning?

The short answer is no.

The long answer is too extensive to fit into this article, so let me try to explain best I can in a few paragraphs.

A full reserve stablecoin is essentially like a pension fund with its own token. In a pension fund, you wire them money, they buy safe assets and give you a certificate that you can redeem later for money. Once you redeem your pension, the fund either pays you out of the yields the assets generated or sells some assets.

In theory, a stablecoin should be similar. You give them a Dollar, and they buy secure assets worth one dollar. When you come to redeem the token, the stablecoin issuer either has made enough ROI from the assets to pay you, or sells assets worth $1.

The difference is that the pension fund is very heavily regulated and audited and the stablecoins currently are not.

A pension fund is only allowed to invest in certain assets and needs to be extremely transparent about that.

A stablecoin can do whatever they want with the money you give them, and you have zero standardized procedures, let alone legal recourse on how they report their holdings.

For my German-speaking readers, here is an interesting article on how Tether has been avoiding getting audited for example.

But even if a stablecoin only buys so-called secure assets, like government bonds and cash equivalents, these have problems. There is a reason why pension funds are in trouble after all. Currently, some treasury bills yield negative nominal rates, all of them yield negative real rates.

So if a company sticks to these “secure” assets, it must operate at a loss against inflation. This means that necessarily any stablecoin operator needs to take enough risk to be able to make an average 15%+ return and beat inflation.

Another downside of the stablecoin approach is that essentially you are creating the same attack vector that killed gold-based currencies.

As Adam describes, the value of coins like Tether itself can be arbitrage traded vs the Dollar by exchanges. Creating the equivalent of upper and lower gold points, as described by Argentarius.

Since these points are only tiny fractions of a percent away from the 1-to-1 peg, the arbitrage opportunity is rather small. Thus, historically, banks used to fractional reserve their gold currencies to leverage the upper and lower gold points.

This unfortunately likely is being done both with Tether and Bitcoin by exchanges at the moment.

There is a significant difference between fractional reserve gold, fractional reserve Bitcoin on one side and fractional reserve stablecoins on the other, however:

In the past, if banks overdid the leverage, they would cause a bank run and go bust. This meant that a portion of those who thought they had a property right to gold, would find out they really only owned paper, the bank would be liquidated, and its asset sold. The proceeds would go to the bank’s creditors and customers.

The same would likely be the case for Bitcoin because even China admits that it is property and thus necessarily should be treated similar to gold. The big advantage of Bitcoin here is that it’s easy to withdraw from exchanges and self custody, thus reducing this counterparty risk to zero.

No matter if you hold physical gold or your own Bitcoin private keys. In both cases, the collapse of a bank or exchange has zero influence on the actual asset you hold.

Not so much with stablecoins.

Firstly, these coins are less legally mature than Bitcoin and often their mother company is based out of obscure jurisdictions, so you can’t be sure that you have any recourse at all. Should a company decide to stop honouring the redemption promise or go bust, you likely have no legal binding agreement with them at all.

Secondly, even if the company does nothing wrong and third parties leverage up with paper stablecoins, the ensuing crash may tear the issuing company to shreds.

In case that happens, it’s not clear that your token has any legal value at all. To my understanding, the issuer may simply stop the redemption, point to fraud by a third party they can’t be blamed for and walk away with the assets.

I hope I made it clear, why stablecoins are a very risky solution to the problem. The next question then is:

Are there better ways to transact in dollars via Bitcoin?

Certainly, no perfect solution exists. The dollar system is deeply flawed, after all, so how could there be flawless ways of using it?

I am convinced however that there are better ways to solve the problem, which we Bitcoiners should build.

The first thing that comes to mind is simply using a classical bank and just hooking it up to Bitcoin. If a bank offers to be the on and off ramp and operate 24/7, the problem disappears. If this bank were to do Bitcoin to Dollar and Dollar to Bitcoin conversion automatically for a fixed fee, say one percent, you would not need stable coins at all.

So, why has nobody done it yet? I assume that it’s similar to why Google, Twitter, Facebook and co. are “for free”. People are used to being the product of giant corporations and seem to be willing to pay the hidden price, as long the official price is zero.

Since, few want to pay for a service and the hidden business models are more profitable anyway, it’s no wonder that the “honest” solutions don’t thrive.

We can only hope that more people fall into the rabbit hole and create a growing market for honest business models.

What do think? Are stablecoins a good solution, for a real problem? How would you solve it? Let me know in the comments, please. If you liked this article, please consider subscribing to my newsletter below.