In the last articles, we discussed what money is and why money was invented. We found that there are different kinds of money. So, what kind of money is Bitcoin?

Is it commodity money? Is it unbacked token money? Or is it something entirely new?

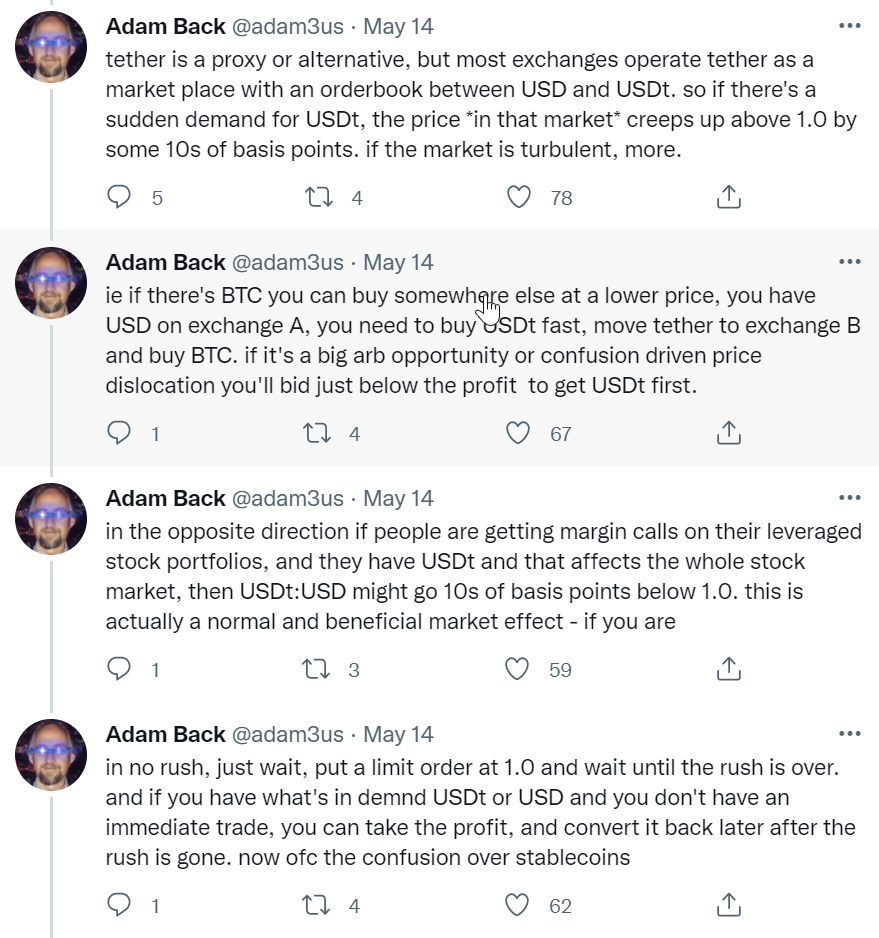

Austrian economists are divided in their assessment of Bitcoin, some see it as the best money ever, while others see it as worthless fraud. As can be visualized by the below tweet from the Swedish Mises Institute.

This goes back to the unfortunate and previously discussed errors/unclarities in Mises’s monetary theory. Which leads many to believe that the only way for sound money to emerge is by means of the regression theorem out of a valuable commodity.

While I agree that the regression theorem accurately describes, how a commodity can become money, it should not be seen as a law that ONLY through it can something become money. Especially since history clearly shows that ledger money is older than commodity money.

The reason for this error according to Argentarius is that most monetary theories only describe what money does and not what it is. He thus separates the concept of money, from the token that represents the money. To make the distinction a bit easier to see, I will call Argentarius’s concept of money “Meta-Money” from here on.

As I laid out in my article “The Evolution of Money”, the reason humans invented the various forms of money, was to represent the virtual Meta-Money. The concept of Meta-Money is brilliantly explained in “The Essence of Money”, I definitely recommend you to read the full book, still let me try to summarize it here:

Meta-Money is the virtual placeholder used when a trade cannot be made directly, but rather needs to be shifted in time, space or party.

A shift in time and place is easy to understand. You deliver 10 crates of beer to your friend’s house on Friday, and the friend pays you back in food and organizing the party at the beach on Saturday.

Meta-Money in this case is the virtual placeholder in your head that says, “I delivered beer, so I am owed food and party.”

Meta-Money is thus a virtual ledger that contains both debts and credits that result from a contract which is only partially fulfilled. One could say that Meta-Money represents the right to just compensation for a service delivered, but not yet paid for.

Tracking this Meta-Money is very difficult as soon as more than a few parties are involved. Especially, if the compensation does not come directly from the person you are trading with.

In the example with the party, this could look as follows:

You deliver 10-crates of beer to your friend’s house and every one of the other guests delivers some food, drink, or snack. The whole stash is then shared at the party. In this case, you deliver the beer to your friend, but the compensation comes not from your friend, but rather from everybody else who attends the party.

Now, how do you track this debt? What do you do, if you brought the beer, but some guests fail to bring the food they promised to bring?

This is the point where money tokens come into play.

The function of a money token is to represent the Meta-Money in a standardized, quantifiable way.

For our party, this could be done by simply issuing a set of vouchers. Everybody who brought his or her promised good, gets 10 vouchers and can thus take ten other food/drink items.

The problem with this approach for said party is obvious: Those who didn’t bring anything will have no fun at all. So, you need to give them a chance to compensate you and the other reliable party goers for your goods.

Conveniently, other monetary tokens already exist, so you can agree on one of the following options:

- People who brought nothing can use Euro/Dollar/Bitcoin to purchase vouchers that can then be redeemed for food.

- You skip the vouchers entirely and set a fixed fee everybody who brought nothing has to pay to get all-you-can-eat access to the buffet.

After the party, the currencies collected can be split equally between all those who brought food/drinks.

Now, what if people bring unequal amounts? You bring 10 crates of beer, somebody else just one. Another person brings an elaborate 3D modelled cake, vs. somebody else’s $1 store bought cake.

If everybody gets the same compensation, you will rightfully feel betrayed. For beers, this would be easy to resolve. If you brought 10 crates, you obviously get 10x as much, as the person who brought one. But how about the cakes? How many $1 cakes equal the labour-intensive 3D cake?

In the small-scale party situation, this conflict can be very difficult to resolve, since valuations are highly subjective. The creator of the 3D cake may feel it’s 1000x more valuable than the $1 cake, while the dollar cake bringer thinks it’s only 10x and others may call it at 100x.

In nationwide or global economies that use a common money token or currency, this conflict of subjective valuations is resolved by price discovery in the market.

If many people buy and sell goods, even though individual valuations differ, a market price emerges. Which means nothing more than that at the current supply, demand and cost levels, you will likely find a buyer for your goods at that price if you are a seller. And you will find a unit of the good to purchase at this price as a buyer.

The problem with these market prices is that they do not only depend on the demand, supply, and cost structures in the market, but also on the characteristics, of the money token used to express the prices.

In the case of the party, this can be easily seen. If every party goer gets 10 vouchers and there are 10 people at the party, every person can get 1% of the food and drinks.

If now suddenly 10 other persons come to the party and the reckless host just also hands everyone 10 vouchers, everybody suddenly can only get half of a percent of all food and drinks.

So one criterium to measure the accuracy of any money token or currency obviously is the total quantity of tokens. If people who have actually earned a token by a partially fulfilled contract, while other people get tokens without having rendered any service, the consequence is a redistribution from people who have delivered value, to people who have not.

But what is “accurate” money?

As we saw above in the cake example, value is subjective and prices need to be discovered via the market process. Market prices fluctuate over time, so at which point in time you look makes a big difference. So, what is the “just” price?

This may seem like an unresolvable riddle. After all, for the past 100 years, central banks have desperately tried to keep prices “stable” and failed miserably.

Luckily, Argentarius made a discovery that can help us get out of the dilemma. He observed that under a hard money (e.g. gold coins) where the overall supply of money tokens changes very slowly over time, the abstract “value” represented by one token remains extremely stable.

If historically, a pair of boots cost 1 gold coin, as long as the difficulty of making the shoes remained the same, the 1 gold coin price would stay the same for centuries.

Only if it gets significantly easier to produce the boots (automation) or significantly harder (natural disaster destroying leather supply), will the price change accordingly.

This may seem a very strange phenomenon, if you learned in school that price depends solely on supply and demand. The answer to the riddle is the velocity of money.

Unlike the vouchers in the party example, a gold coin does not get destroyed/devalued when it is used. So, 1 Gold coin can be used 100, 1000 or even a million times to buy one pair of boots. The velocity of money (i.e. how often the average coin is spent per year), thus, regulates the amount of Meta-Money represented by the tokens to a consistent level. One could say that the velocity of money automatically adjusts to offset fluctuations in the supply and demand for goods.

If you studied Keynesian economics, this probably will sound like an outrageous claim to you, even though it is not a claim at all, but rather an observation made by Argentarius.

Let me try to explain to you some of the factors that enable this kind of automatic price stability under hard money:

- People have an uncanny ability to remember prices of common commodities. Here in Germany, even over two decades into the reign of the Euro, you will still hear people refer to the old, relatively stable Mark prices.

“What, this costs now €10? That’s 20 Marks, this used to cost only 5 Marks.”

This price memory is one factor that makes market prices for commodities slow to change under hard money. - Another factor is that, while the velocity of money changes, hard money means that the absolute number of tokens doesn’t change. And every transaction covered in the velocity of money is done by two parties agreeing on a price for a good or service.

While the subjective valuation, and thus agreed price, may be above or below market price, the “loss” of one party in any given trade means an equal amount of “gain” for the other party. Overall, the net results cancel out and the “value” represented by each money token remains stable.

In a nutshell, this means that hard money does not require a central bank to keep prices stable. Market processes and human psychology automatically regulate the money velocity, so each money token represents a relatively stable purchasing power or “value”.

If a hard money market price goes down long-term, this is not deflation, but rather an indication that the production of a good has gotten easier. Vice versa, if there are sustained price increases it means that it has gotten harder to satisfy the demand, harder to produce the good in question.

If a currency supply expands, the equilibrium is broken and the market will need some time to reprice all the goods in terms of the new total supply of tokens. If the monetary supply is expanding faster than the market can balance itself, the consequence is that the “value” represented, transferred and stored in each money token will be distorted.

The goods and services preferred by the ones closest to the source of tokens will get up first and higher than the goods and services preferred by those furthest from the source. This is known as the Cantillion Effect.

This mechanism is also the reason, why central banks were able to create outrageous amounts of money tokens over the past decades and yet, consumer prices remained relatively low.

The newly created money was parked in assets by the first receivers (banks and large corporations) and did not circulate. Thus, only asset prices exploded, and money velocity was artificially suppressed.

In a nutshell, this is the reason, hard money requires a stable supply to represent Meta-Money accurately:

According to Argentarius, if the supply of a money token is stable (in the ideal case, exactly constant), then that token will represent a constant “value” across the economy that uses that token. And this “value” will stay stable over time and space so that you can use the token as a universal coupon. A coupon that will give you the “just” compensation you are due for services rendered and goods delivered, no matter where, when or with whom you “redeem” it.

From Argentarius findings, it becomes clear that all the different kinds of money, be it Fiat paper money, Gold coins, Mesopotamian clay tablets or Bitcoin are only different money tokens, not different forms of Meta-Money.

The properties of a token only influence how accurately the token can represent the Meta-Money over time, space and party.

Ok, not so fast. Commodity moneys are a special case… While a Fiat money has no other value than the Meta-Money captured, commodities also have a non-monetary value.

This is a point that in my opinion has confused many economists. When you review commodity money, you need to carefully separate the uses and valuations.

If you receive a gold coin, melt it down and make electronic circuits, then you have not used it as money at all, but purely as a commodity. And your valuation of the coin will be based on how useful the commodity “gold” contained in it is to you.

If you receive a gold coin intending to spend it to get other goods, you value it according to the goods you hope to get for it and how valuable these are to you. In that case, it makes no difference (as long as the number of tokens in circulation doesn’t change) whether the coin is made of gold or paper. You value it based on the Meta-Money represented and use it purely as money, not as commodity.

When you use a commodity as money, the physical characteristics of the good do only indirectly influence the value of the money token, not directly as if consumed.

This happens in two ways:

Firstly, the commodity value of the token set’s upper and lower bounds to the amount of Meta-Money it can store.

If the commodity value of gold should get higher than its monetary value (negative monetary premium) than people will stop using it as money token and consume it instead.

If the production cost falls and availability of the commodity gets higher, then the value of the money tokens must fall because people will simply produce more tokens until equilibrium is restored.

Since a scarce good like gold can store much more Meta-Money than its value as commodity, the standard case for any commodity money is a positive and rather large monetary premium. Meaning that the use value is negligibly small compared to the monetary value.

This leads to misallocation of resources, since the monetary use forces commodity consumers to pay a significantly higher price than the “normal” market price of the commodity.

For this reason, among others, usually commodities like gold, silver, or seashells become money, since they are not a vital part of the economy. Times when food, real estate or other basic necessity gain a significant monetary premium are typically desperate times, accompanied by social unrest.

The second way the physical properties of a commodity influence its value as a money token is their usability. How scarce, how divisible, how durable, etc. is a good, determines how well it can be used as money.

Eggs are terrible monetary tokens, they are too readily available, not divisible and spoil fast.

Gold is a very good monetary token because it is scarce, lasts forever and is relatively easily divisible.

Still, gold is far from perfect. It is too valuable given its density, which is why historically small purchases were done in Silver, which is not quite as scarce as gold and almost as durable.

Furthermore, Gold is quite hard to ship globally and easily stolen, which makes it awful to carry for daily groceries or use in international trade.

A significant downside of all commodities is that the difficulty of production changes with time. Problematic are especially big technological breakthroughs that can make a formerly scarce token abundant and thus worthless (see Rai Stones, Cowrie Shells).

NOTE: Gold is not safe from this fate either, asteroid mining is probably just a few decades away and earth is not fully explored yet.

In comparison to commodities, Fiat, debt-based and ledger currencies have the advantage that the total supply is not dependent on any natural/industrial process, but in theory can be set to a fixed amount.

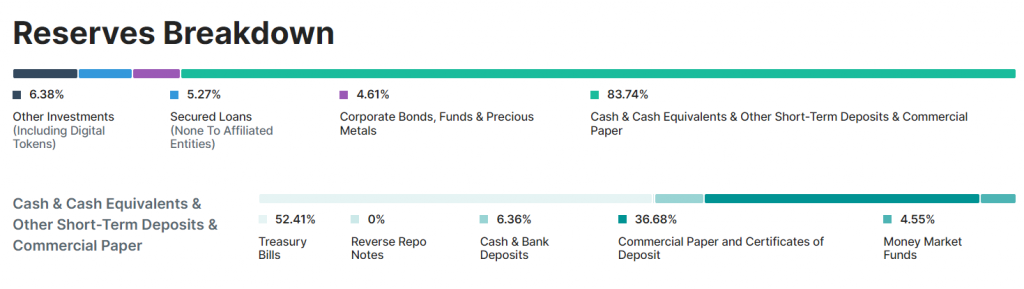

The problem with that however is that until Bitcoin came along, you always had to trust somebody to keep the ledger honest and not expand the amount of money tokens.

So far, every human organization in charge of the money supply has miserably failed in keeping the money honest and limited in the long run. Thus, Fiat currencies were almost always bad stores of value and extremely inaccurate in representing Meta-Money.

The best theoretical money would be a hypothetical god-money. A token, created by an incorruptible deity who ensures that a fixed number of tokens exist and smites anybody who dares try to forge new tokens.

Bitcoin is as close to god-money, as one can get, without having a trustable deity to control the money.

The great differentiator in Bitcoin is the difficulty adjustment. No matter, how efficient miners get or if countries ban mining. Every 2016 blocks, difficulty is adjusted based on the time between blocks in the last period, to keep the time at an average of 10 minutes per block.

This, combined with the overall incentive structure Bitcoin provides, makes it almost impossible to change the schedule of Bitcoin issuance or expand the total supply.

Bitcoin is an unprecedented, wholly new kind of money which has both the advantages of commodity money and Fiat money, without the individual downsides and many never before seen upsides.

This all makes Bitcoin the most accurate money token ever invented, maybe even the best token possible.

The more Bitcoin grows in usage, the more monetary premium it will absorb from commodities and other forms of money. Until hopefully in the future, we will have the whole Meta-Money of the global (or perhaps interplanetary) economy accurately represented by Bitcoin.

We will discuss this future and its implications in one of the upcoming articles. If you don’t want to miss any new articles, please subscribe to my newsletter below.