How was money invented? Why do we need currencies? What is the best money?

In a previous article, I explained the differences in monetary theory between Mises (Austrian School) and Argentarius.

Recent discussions between me and proponents of Mises’s theory have shown me that there are several points that are not entirely clear. So today I would like to dive a bit deeper and show on practical examples, how and why money evolved and what good money is.

Furthermore, I will try to show exactly at which points the two theories diverge and where I see the problems with Mises’s explanation.

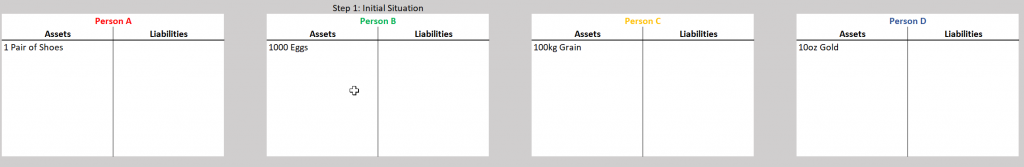

Throughout all our examples, we will use the four Persons A, B, C and D. You can see the goods they start out with, in the below picture.

The transaction we want to resolve is that Person B wishes to buy a pair of shoes from Person A.

Example 1

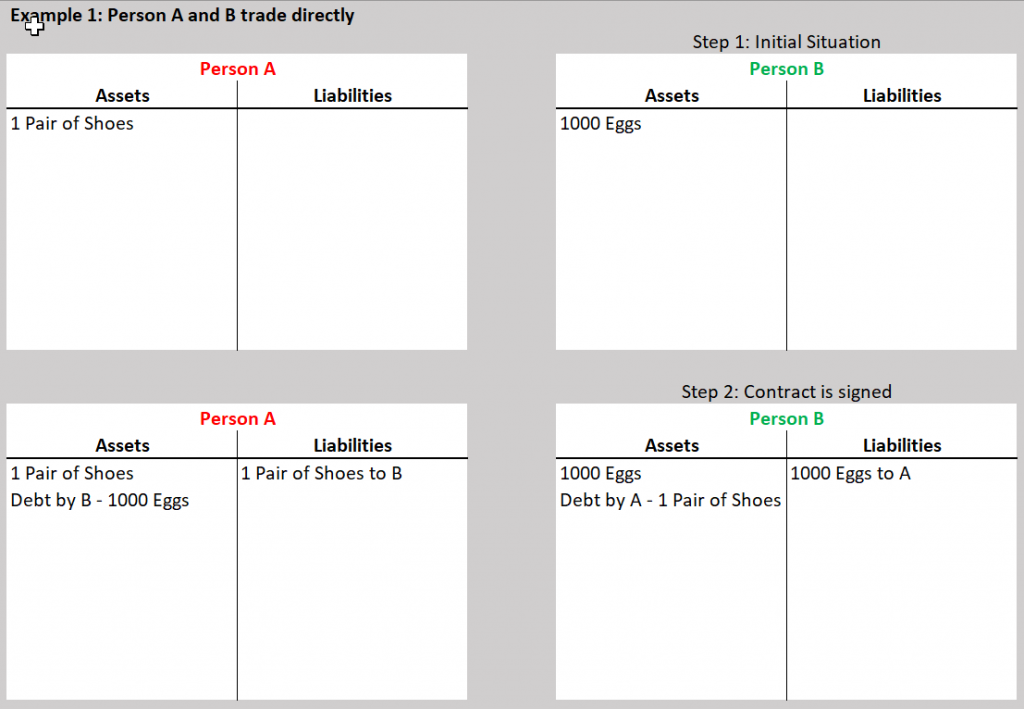

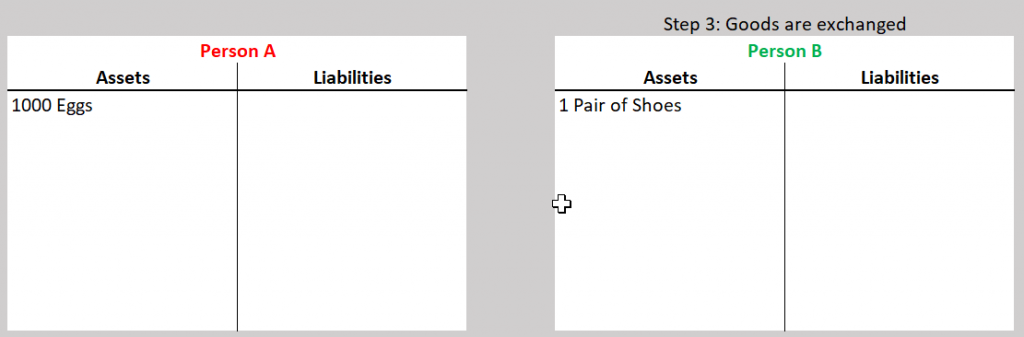

The First Example will be simple. Person A and B do a direct barter trade. So, A and B simply draft a contract. Since C and D are not involved in this trade, we will omit their balance sheets for now.

NOTE: Historically these types of trade were done verbally, so the contracts and balance sheets in Examples 1, 2 and 2a are only for visualization. Practically, they would usually be in memory only.

Once the contract is signed, the goods are exchanged. Once both have delivered, the debts from the contract are erased and the trade is done.

Example 2

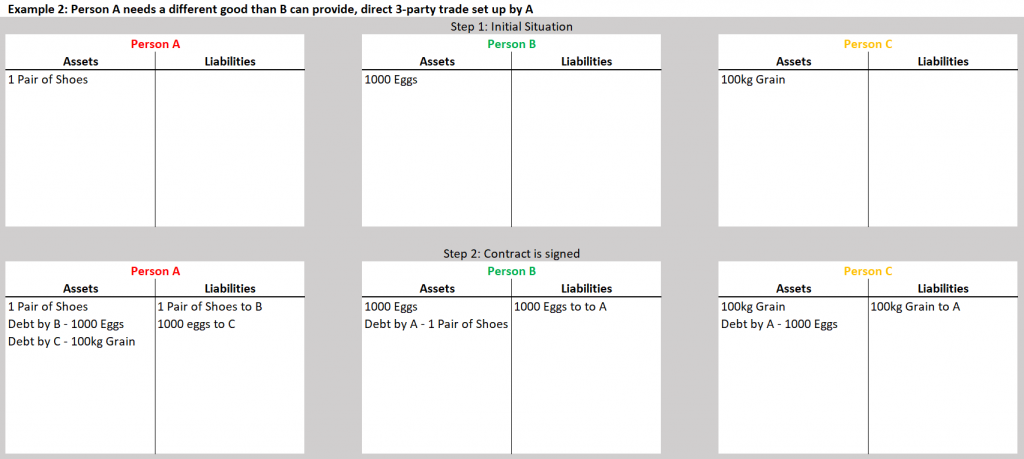

In the next example, we increase difficulty. Person A now doesn’t want eggs, but rather grain, which only Person C can provide.

To facilitate this trade, Person A negotiates a three party barter contract.

To fulfil the contract, first A and B need to exchange goods, and then A and C exchange goods.

As you can see, arranging a three party barter trade is already rather difficult, and if not all goods are available at the same time, the Person facilitating the trade must take quite some risk, since they need to trust their partners and give them credit.

This method of trading gets impractical quickly once more than three parties are involved.

Example 2a

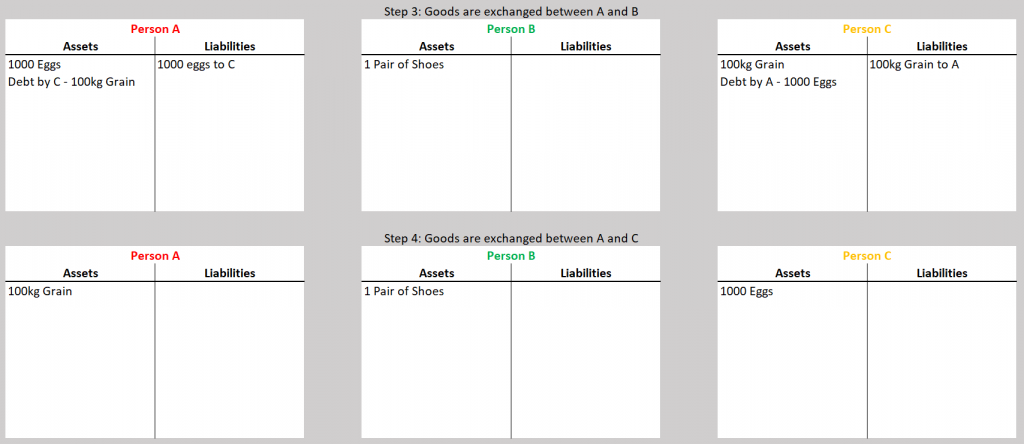

So, if Person A is not willing to set up a three-party contract, the other option for B is to acquire the goods A wants in a separate trade.

To reduce the risk of giving credit, the three parties meet at one place and goods are exchanged directly.

While this is a safer way to trade, it’s even less practical to arrange, the more parties and different types of goods are involved.

Example 3

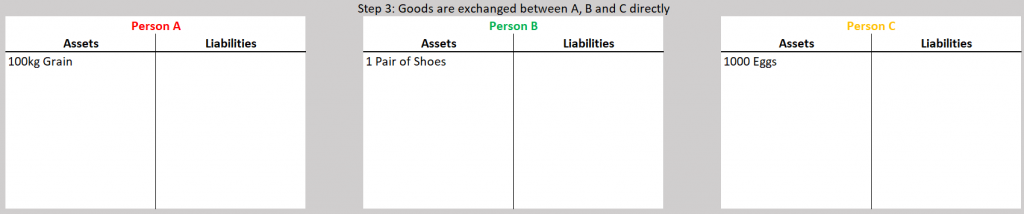

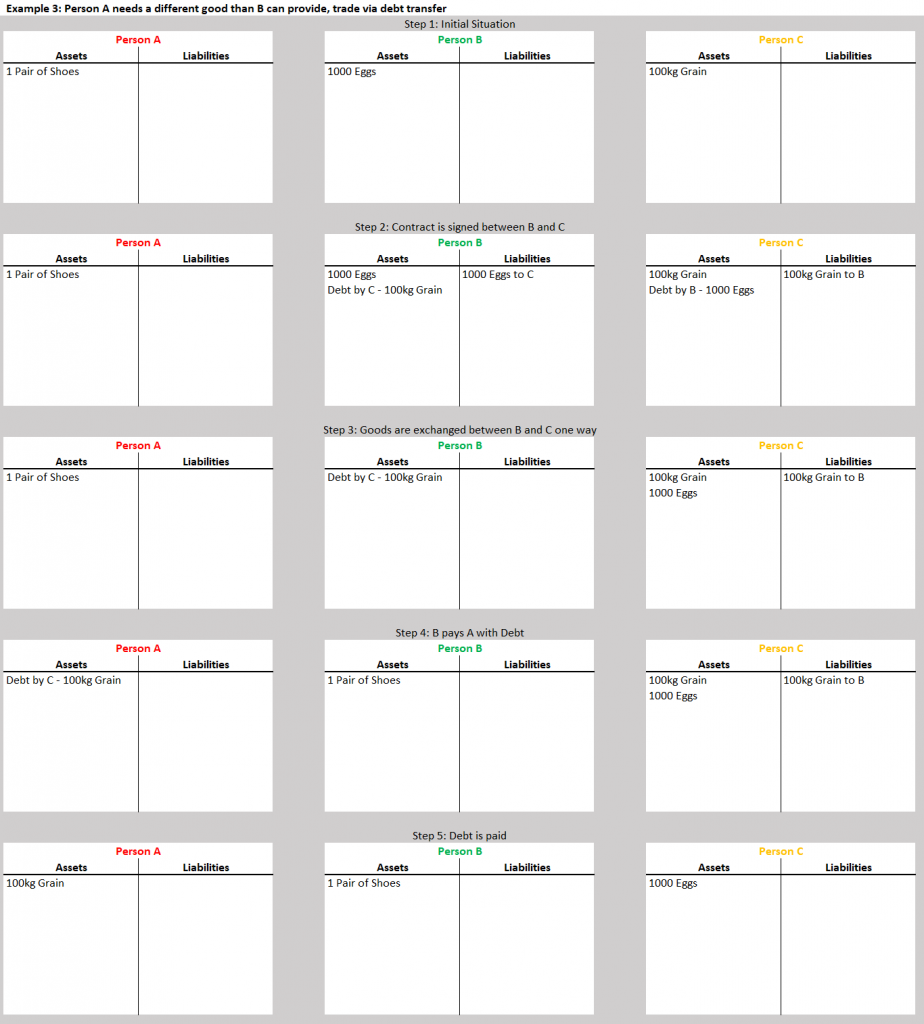

To resolve this issue, humanity invented the balance sheet and the debt transfer.

Archaeologist have found clay tablets, showing such trades were done as much as 5000 years ago.

Let’s have a look how such a clay tablet trade works:

This is much more practical, but since clay tablets are not too easily edited, another trick needed to be invented.

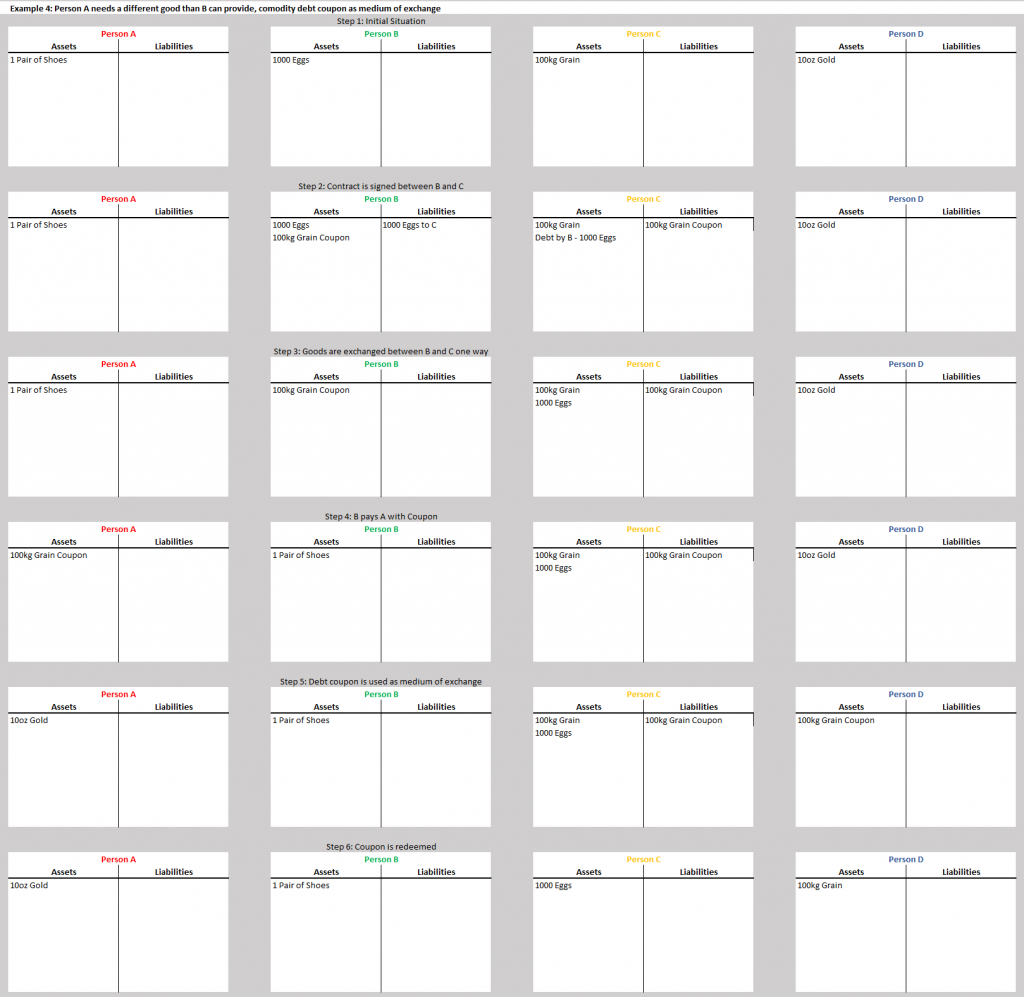

Example 4

Instead of rewriting clay tablets to represent who owes who, we will now simply use a Coupon redeemable in grain, signed by Person C as medium of exchange.

To spice things up a little, we will assume now that A doesn’t want to redeem the grain coupon, but they rather want Gold, which is available from D who in turn wants grain.

Such a coupon system is already the beginning of a commodity money, slowly turning into a currency.

The main evolutionary step from coupons/commodities functioning as money to currency, is the market process by which a commodity—like gold—becomes so widely accepted that everybody accepts the commodity as payment, even without any intention to directly exchange it for a good they actually need.

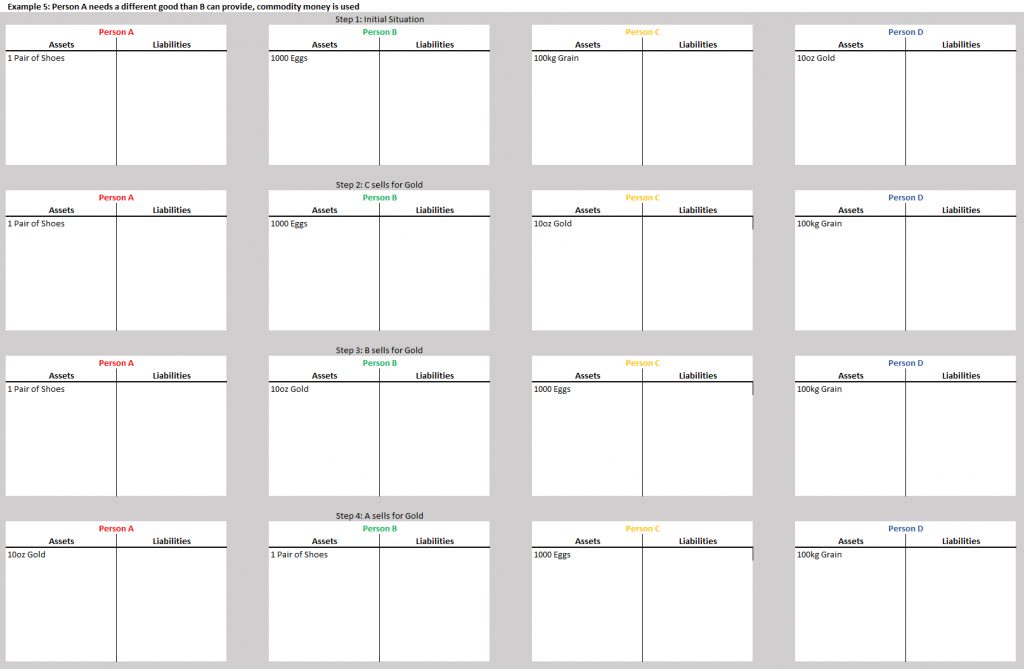

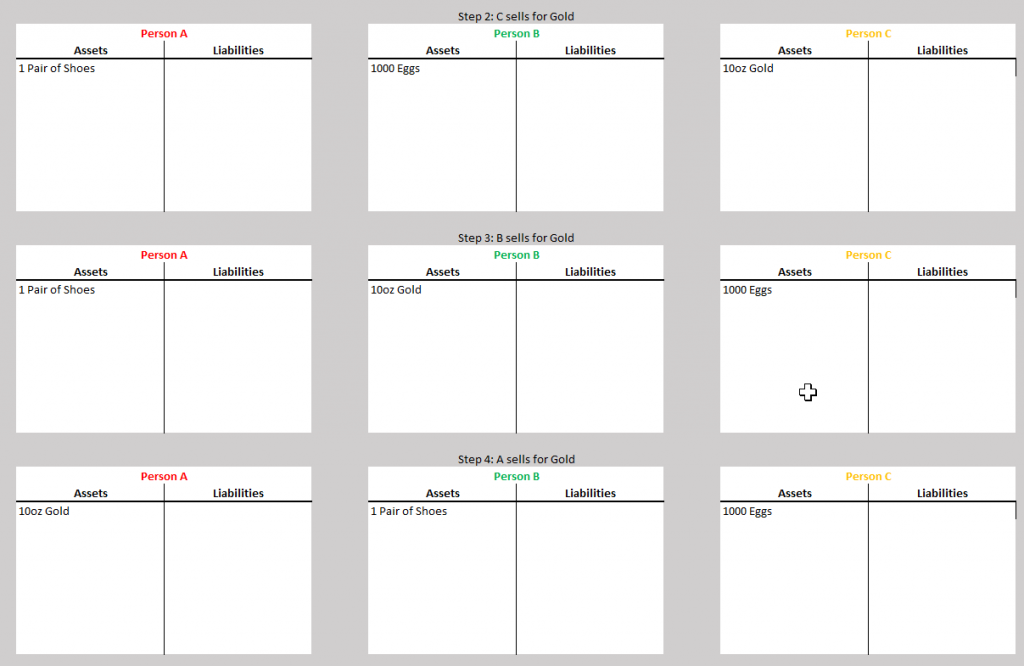

Example 5

If we do the same exchange of goods like in Example 4, but with Gold as widely accepted medium of exchange, it will look like this:

As you can see, this is a way easier way to trade that does not require any balance sheets or tracking of debts.

With this system, it is also possible to have the commodity money—Gold—change hands thousands, even millions of times, before the commodity actually reaches somebody who wants the Gold as a commodity itself and not for the monetary function.

Up to this point, the theories of Argentarius and Mises agree. The differences begin, once there is a standard medium of exchange.

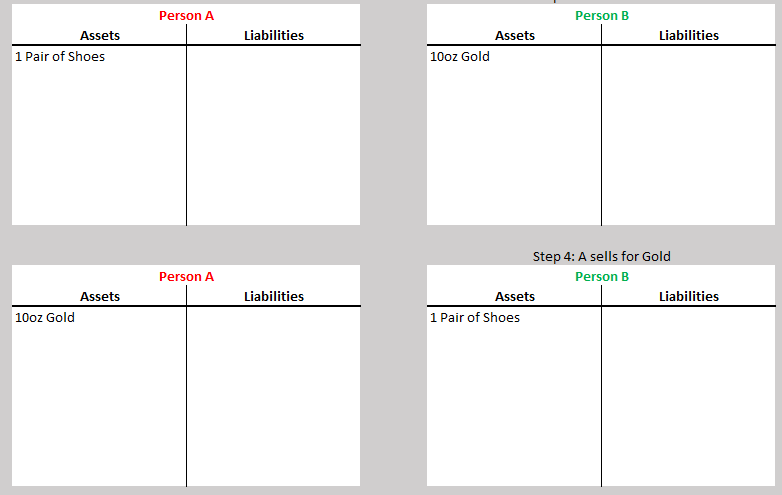

Mises would now argue that you can simply write the transaction from Example 1 as follows:

Argentarius however would argue we would still need to take the full chain into account as shown in Example 5. If this example was rewritten to just show Person A’s and B’s direct trades, it would look like this:

This way of looking at things may look like nitpicking to you, but it is crucial, once inflation and changing production methods come into play.

If you use the Mises style analysis in times of high inflation, you will be selling yourself poor.

As Argentarius records, during the Weimar inflation days, business owners accounted by simply adding a profit margin to their costs.

While this is quite a common practice and not necessarily harmful in times of low inflation, as soon as inflation becomes faster than your business cycle, it will lead to the “selling poor” effect.

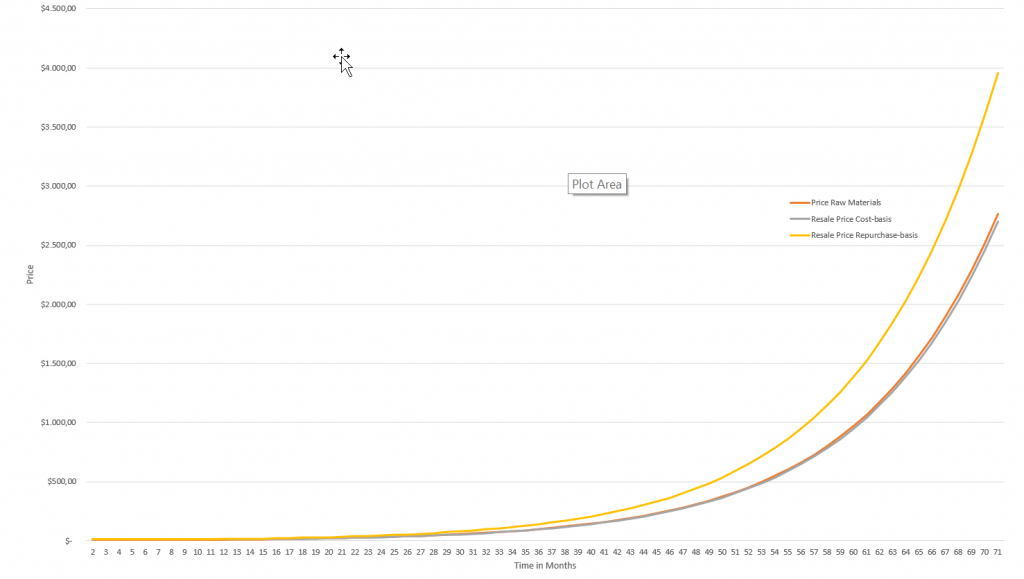

What this effect means can be seen in the chart below. The grey line represents the material costs, which after 1 year of no inflation start to inflate at 10% per month.

The orange line is a merchant who has a 3-month production cycle and calculates his prices based on 30% margin on cost.

The yellow line is a merchant who calculates his prices after production by what he expects to be the next month material cost.

As you can see, at such high inflation rates, the orange merchant rapidly falls into the “selling poor” zone, where despite a 30% profit on paper, his stock dwindles, and he has to go out of business.

Of course, it is not always possible to accurately predict inflation and such high inflation rates are rare.

Nevertheless, this example highlights the differences between Mises and Argentarius.

Mises operates under the framework of Praxeology. While this is a great tool to evaluate economic processes, like any model it makes simplifications.

These simplifications are necessary to have any chance at analysis of complex systems.

In edge cases, such simplifications can lead to erroneous results, which is why you always need to stay aware of these assumptions.

As Rothbard explained, Praxeology, unlike Psychology, does only concern itself with how people act, not with why they act as they do.

This can be a problem, when it comes to analysing contractual relationships. A contract is nothing more than a declaration of what two parties want.

So, when judging the quality of a contract, it’s important to check whether all parties received the result desired from the contract.

Unfortunately, humans are not always fully aware of their intentions, so contracts can be written in a way that looks acceptable to all parties, but in fact turns out to have been contrary to the intent of the parties.

This can be clearly seen in the above example.

The merchant, who calculates 30% profit on cost, does so, not because he wanted to have the money, but because he wanted to restock, pay his bills and maybe save or invest a little.

Basically, he wanted to do a multi party barter trade. He intended not to have any money token or currency, but rather to exchange finished goods, for raw materials, factories, machine depreciation, etc.

He only used money as a placeholder, due to convenience. Since the money worked for a while, the merchant fell into the trap where he forgot that the money was not the good he actually desired and thus sold himself poor.

Conclusion

Money tokens were invented to facilitate multi party barter trades. Their function is just a placeholder. Thus, the best money token is the one that most accurately transports a barter “value” over time, space and party.

In the next article, we will discuss what this means for the engineering of sound money.